The tariff regime of President Trump has reduced the confidence of investors in what has long been considered not only a safe bet for investors, but also a basis of the US economy: the United States treasure bonds.

Long perception dates that treasures are a “risk -free” place to park the money, a perception that has a long crucial leg for the United States government, companies and consumers equally to maintain the costs of low loans is the sea of the seas of the sea to the folding tar folding.

“In a nutshell, the long link rate of the United States: the treasure, is the most important price in global finances,” said David McWilliams, a global economist and author of “The History of Money: a Story of Humanity,” The Post said.

“It determines how much the US government pays. In interest, the debt size of the United States government, the price of all US mortgages is determined by it and the value of each company in Wall Street Voice of it.”

McWilliams said that when the United States yields increase, “everything else falls.”

“If the monetary world had a northern star, the United States Treasury rate would be everything.”

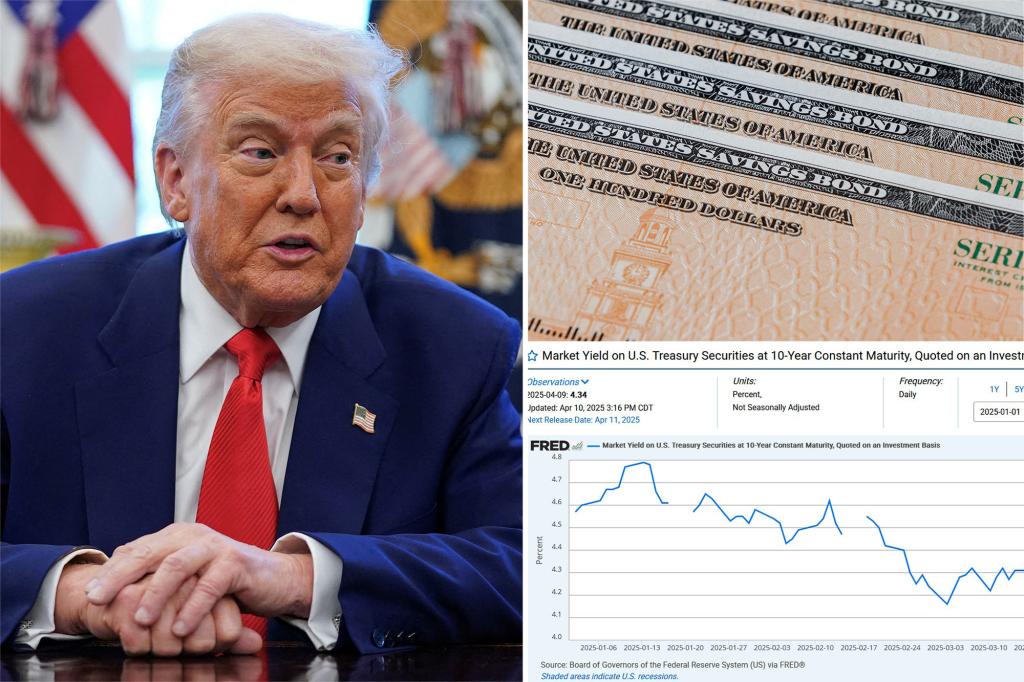

Treasury yields are aspiring

Typically, the treasury are found in times of capital market stress. This time, however, they are falling together with the actions.

Variable rental markets have thrown an amazing amount of $ 7.7 billion after the broad announcement of Trump rates on April 2. Meanwhile, in the last four days, the 10 -year treasure yield has shot 4.20% to 4.43%, marking its strongest increase from the height of the financial crisis of 2008.

Multiple factors are promoting the sale of the sale. Worldwide, bond yields have increased on fears of inflation and political developments such as military accumulation and uncertainty of Germany in the elections of France.

“The recent sale of US treasures. UU. … Underline significant changes in the bond market,” said Mark White, a heritage advisor and managing partner of Karpf, White & Associates Wealth Management, post.

“The increase in treasure treasures generally indicates investors’ concerns about inflation and fiscal policy, which can lead to higher indebtedness costs throughout the economy.”

White warned that yields can continually increase, possible that are approaching 5%.

The pain is a special acute at the long end of the performance curve. The 30 -year bonus yield has increased almost half of a percentage point in just three days, its greatest increase since 1982.

Concerns about foreign property

The treasurers are also under exceptional pressure due to their ubiquity and the potential for foreign reaction against the policies of the United States. Currently, foreign investors have more than $ 8.5 billion in treasurers, according to the January data of the Treasury Department.

Japan and China are the two largest headlines, with China in the scrutiny of private drawing in the midst of intense commercial tensions.

However, due to opaque transactions through financial centers such as London and the Cayman Islands, the total extension of the foreign exposure is still clear, according to the Wall Street Journal.

While there was a long time conspiracy theories that the Chinese government could move to sell its $ 800 billion in Treasury bonds, there are simpler explanations of why prices have created in recent days that they have been that the qualification of the fourth would be around the world.

Treasurers are not only a point of reference for everything, from mortgages to sovereign debts, but also are used as guarantees in the fasting stripes of financial markets.

“Treasury bonds are traditional views such as the ‘Risk free rate’, so the volatility here is important for all assets of assets,” he told The Post Cody Moore, a wealth advisor based in Georgia. “As clarity arises in commercial policy, I hope that the treasure market stabilizes, since markets yearn for certainty.”

Also drop in US dollars

The agitation is also wrapping the US dollar, which suffered its largest drop since 2022.

ICE US dollar index fell more than 8% in the year to date. It was quoted at 100.26 Axis or 12:50 pm Eastern time of Friday, the lowest level since September.

It is likely that the growing fear of a possible recession also contributes to the decrease.

The most acute losses of the dollar this week were about traditional safe coins, such as Japanese Yen and the Swiss Franco, suggesting a broader flight to security.

“The fiscal policy of the United States is eroding credibility, legitimacy and stability of the US financial system, putting the state of the dollar at risk as the world reserve currency,” Christopher Vecchio, head of Futures and Forex in Tastylive.

Vecchio lamented the fact that “US assets are acting as if we were in the middle of an emerging market crisis: currency depreciation, yields of Soing bonds and crater actions.”

“During most of my life, Dollarzation sounded like a fantasy. This week, it begins to feel real as the world put the United States for sale in the middle of the hurried attempt of the world economy to rewrite the global commercial order.”