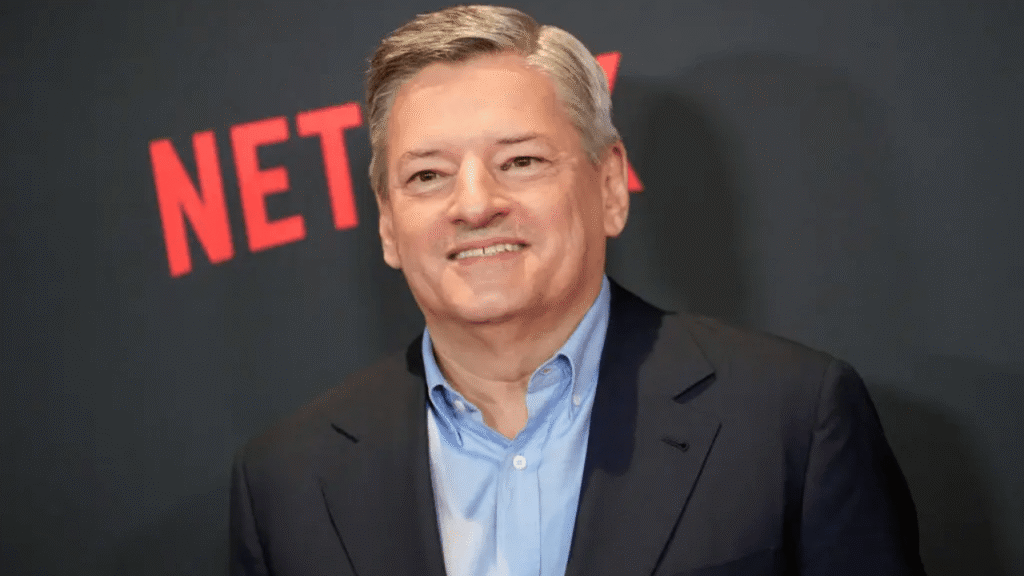

Streaming giant Netflix has set its sights on reaching a market capitalization of $1 trillion, according to co-CEO Ted Sarandos.

Speaking at a recent conference, Sarandos revealed that the streaming service giant currently holds just 5% of global consumer spending in the entertainment segments it operates in. He announced this as evidence of “enormous room to grow, just in the thing that we do.” Over the last five years, Netflix has doubled its revenue, clocked a 10x growth on its grown profits, and tripled its market valuation, according to Sarandos. These financial achievements, he stated, confirm a clear “path” toward the trillion-dollar valuation goal. However, he stressed that future progress remains “incredibly dependent on executing well.”

This development comes at a time when Netflix is not abandoning its core streaming business but instead branching into adjacent sectors to diversify its revenue streams. So far, the streaming service giant has rolled out a library of mobile games that are included with a Netflix subscription at no extra cost. These games span various genres and include titles based on their popular shows (like Stranger Things: 1984) and original games. The aim is to increase subscriber engagement and offer more value within the existing subscription, and users can find a selection of their games available for download through the Netflix mobile app on both iOS and Android devices. In addition to this, it also streamed two live NFL games on Christmas Day in 2024, and secured a substantial 10-year deal to exclusively broadcast WWE’s weekly Raw program starting in 2025.

Streaming giant Netflix has set its sights on reaching a market capitalization of $1 trillion, according to co-CEO Ted Sarandos.

Speaking at a recent conference, Sarandos revealed that the streaming service giant currently holds just 5% of global consumer spending in the entertainment segments it operates in. He announced this as evidence of “enormous room to grow, just in the thing that we do.” Over the last five years, Netflix has doubled its revenue, clocked a 10x growth on its grown profits, and tripled its market valuation, according to Sarandos. These financial achievements, he stated, confirm a clear “path” toward the trillion-dollar valuation goal. However, he stressed that future progress remains “incredibly dependent on executing well.”

This development comes at a time when Netflix is not abandoning its core streaming business but instead branching into adjacent sectors to diversify its revenue streams. So far, the streaming service giant has rolled out a library of mobile games that are included with a Netflix subscription at no extra cost. These games span various genres and include titles based on their popular shows (like Stranger Things: 1984) and original games. The aim is to increase subscriber engagement and offer more value within the existing subscription, and users can find a selection of their games available for download through the Netflix mobile app on both iOS and Android devices. In addition to this, it also streamed two live NFL games on Christmas Day in 2024, and secured a substantial 10-year deal to exclusively broadcast WWE’s weekly Raw program starting in 2025.

In addition to this, the firm is also apping into merchandising and retail to capitalize on the popularity of its original programming. Sarandos revealed that one branded product, Surfer Boy Pizza — based on the Stranger Things franchise — has become the best-selling frozen pizza at Walmart, illustrating the cross-market potential of Netflix IP.

Later this year, Netflix is set to launch Netflix House in Philadelphia and Dallas. These spaces will blend experiential retail with dining and rotating ticketed attractions based on different Netflix shows. Sarandos remarked that this is “the next generation of what a theme park might be,” aiming for regular consumer engagement rather than one-time visits.